Recent legislative activity around the Bipartisan Budget Act of 2018 has resulted in (once again) extending the commercial energy efficiency tax deduction for another year, through the 2017 tax year. Even if your business has to file an extension, it might be worth it to receive these special tax deductions.

Of course, it would be better if our federal government could decide on whether or not this tax break would be extended in advance of the year for which it is valid, but you can still take advantage of this tax deduction.

FYI, because this extension of this special tax benefit has been enabled in 2015, 2016 and now 2017, one could guess that it might happen in 2018, too. You might use that information to help you justify more projects to get approved in 2018.

The 179D commercial energy efficiency tax deduction is a special tax break that’s not linked to assets, but related to square footage of a building that installed energy-efficiency equipment. Therefore it’s an extra tax deduction to take advantage of (if your project qualifies).

More handpicked content from this expert:

It’s not extremely difficult to qualify for this deduction, and I used this approach for one of my own my own buildings in 2016:

- I was able to deduct about $34,000 off my taxes

- While spending about $20,000

- Reducing my taxable income by $14,000

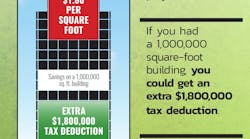

The extra tax deduction is $1.80 per square foot if you do qualifying energy efficiency projects. For example, if you had a 1,000,000 square-foot building, you could get an extra $1,800,000 tax deduction. For a company paying 33% tax rate, this translates to about $600,000 in cash.

Note that for any manufacturer or business in general, to make an equivalent $600,000 in cash (profit), you would have to sell a lot of products (maybe $6,000,000 at a 10% profit margin to get the same result as this tax break). And the tax break approach is far less risky than assuming you could actually sell more products.

Deduction Breakdown

The 179D energy efficient building deduction qualification criteria:

- Any commercial property or 4-plus story multifamily property or newly constructed prior to December 31, 2017;

- With retrofits to lighting, HVAC or envelope components resulting in reduced energy consumption.

Eligible properties qualify for up to $1.80 per square foot or:

- $0.60 for lighting

- $0.60 for HVAC

- $0.60 for envelope retrofits

Thus, if you only qualified for a partial deduction (such as a lighting retrofit) you would still get $.60 a square foot “extra” deduction. However, you have a short window to perform certifications so that your company (or your client’s company) can capture these benefits prior to filing the 2017 tax returns.

In addition to the EPAct federal tax program, there are several other programs that can be used to supplement a company’s drive to become more energy efficient including utility incentive rebates as well as other federal and state government grants.

Bill Bissmeyer, aka Dr. EPAct, is the “$17 million man” because he has helped American companies receive that amount in tax benefits via an “additional” deduction for energy projects/retrofits. He shares two case studies that show the real-world impact of the EPAct deductions.

Case Study #1: Large Midwestern Warehouse

An Indiana corporation which has a 100,000 square foot warehouse decided to change its lights in 2017. It replaced traditional fluorescent light fixtures with 250 new American-made LED fixtures.

This corporation would qualify for a one-time federal tax deduction of $60,000 and possibly more if it did any HVAC or insulation retrofits. To obtain this federal tax deduction, the corporation would only have to have an independent engineering certification of the installation of the new lighting system.

Case Study #2: Municipal Owned Airport Hanger

A design-build contractor designs a high-efficiency infrared heating system for a 50,000 square foot local municipal airport hanger. Since the municipal airport falls under the qualification of a government building, there’s no benefit for them to have a federal tax deduction. A municipal building doesn’t pay taxes.

However, in an effort to motivate energy efficiency in government buildings, the federal tax deduction can be passed over to the entity or person who performs the design of the energy efficiency building.

In this case, the designer can qualify for a federal tax deduction. In this case, the deduction is between $30,000 and $90,000 dollars.

Again, to qualify for this federal tax deduction, the designer would have an independent engineering certification study performed, and the designer would receive a form to submit with his federal income tax. The designer can then pass on a portion of the cash value to the client.

More Information

Thanks to Dr. EPAct, for keeping up with the legislation and informing us all about the benefits.

Bissmeyer, BSBA, MBA, CEM, has been a national leader in promoting the use of government incentives to help American companies finance their energy efficiency projects. He is past president of the Indiana Association of Energy Engineers as well as president of four ASHRAE chapters in the Midwest.

Feel free to contact Bissmeyer if you need additional questions or assistance. He can be reached at 317-546-3000 or [email protected].